Increase Your Credit Limit Using These 10 Strategies [August, 2024]

Credit cards are indispensable these days. For emergency expenditures, when you don’t want to block your savings or your liquid cash, you depend on credit cards. Making regular payments, checking your expenses, and staying within your credit limit is the smartest way to operate your credit cards. But if you have a low credit limit, it can hamper your convenience of shopping or pay for bills. You can’t spend unlimited amounts on credit cards which can eventually reduce your purchasing power.

Several factors determine your credit card limit, and if you want to increase your credit limits, you must follow certain strategies. Here is a comprehensive guide that will talk about tips and techniques that you can use to enhance your credit limit.

Should You Opt for a Credit Card Limit Increase?

There is no harm in getting an approved limit that can be used in emergencies. However, this can often entice you to splurge on things you don’t need. If you spend too much, you can lose a lot of money by not being able to pay off the outstanding balance and paying interest on the amount owed to your credit card company. You must go for a credit card limit increase only if you are not a spendthrift and can smartly manage the amount of credit approved.

How To Increase Credit Limit?

Certain eligibility factors help increase your credit limits. Here are the top ways in which you can enhance your credit limit:

1. Apply For A New Card

The easiest way is to apply for a new credit card with a higher credit limit. Purchasing additional credit cards spreads your balance across multiple cards, so you maintain good credit to pay your bills on time.

2. Apply For a Credit Card Limit Increase In The Existing Card Amount

It is convenient to increase the limit of an existing card. Credit card issuers will check your creditworthiness to see if you qualify. While doing this, do not apply for another card or a pay raise, as this could affect your credit score. Support your request with legitimate reasons, as simply asking for a credit card limit increase is not enough. You must support it for reasons like an income increase, paying bills regularly, a better job prospect, etc.

3. Consider Annual Credit Limit Approvals

Most banks will offer an annual credit card limit increase if you pay your balance on pre-approved time, so you must not miss this opportunity. Even if you don’t need it, you must still use the offer as it normally comes with several bonuses and rewards.

4. Improve Your Credit Score

Banks consider your credit score when setting credit card limits, so it’s a good idea to ensure you have a high score. A higher credit card limit is always a good idea, and there is no reason for the bank to refuse to increase credit limits.

5. Be Professional

When interacting with your credit card providers, always behave politely and professionally. Your attitude plays a big role in deciphering your relationship with your financial institution. If you are polite, you may be able to convince the bank to offer a better and higher credit limit. If you already have too much debt, we recommend that you reduce your debt, get rid of the fixed monthly fee, and then request a credit card limit increase.

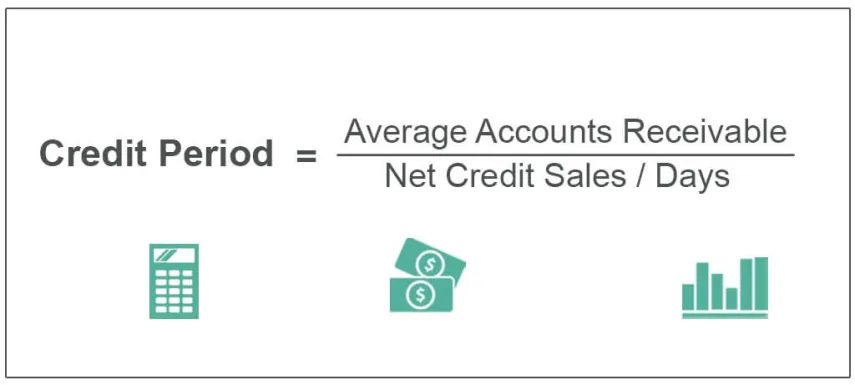

6. Watch Your Credit Utilisation Ratio

It is suggested not to go beyond 30% if the credit limit is available. This enables low usage, indicating to credit card companies that you’re not using as much to manage your spending. Also, using your credit card within the 70% recommended range positively affects your credit score and ensures a higher ranking. Low credit usage leads to a higher credit score, indirectly leading to a higher credit limit.

7. Make Sure Your Payments Are In Full

Payment should be made in full monthly to avoid the high-interest charges on your credit card balance. Also, make sure you pay before the due date and don’t wait until the last minute. If you have the funds, you must immediately pay as the billing cycle is over and your monthly bill is generated. If you have unpaid charges from the previous month that have been carried forward, it is recommended to settle them first. Paying your outstanding expenses on time shows the credit card company that you can handle your debt with care.

8. Prove Increased Income

If you have ventured into a side hack or taken up another job, submit the necessary documentation to your credit card company. You must provide proof that your monthly income has been increased, and you need to prove your affordability of a high credit card limit increase. It also shows that your repayment capacity is improving.

9. Reduce Or Eliminate Some Of Your Debt

The higher your outstanding debt, the lower your credit card company will trust you. It is better to shop with your means and make a full payment to avoid any interest charged on the usage. Usually, banks provide a 40-day interest-free period after purchase. So, if you pay the amount within the stipulated time, no interest will be charged. However, if you fail to do so, banks will charge a high-interest rate on the balance. So only go for a credit card limit increase if you can eliminate your debt rather than increasing it.

Conclusion

Using your credit card to purchase goods and services is highly convenient. There are times when you plan that special vacation with your family or want to take advantage of that annual sale on utilities. You may want to opt for a credit card limit increase to access more funds. So, it’s a great move to enhance your available funds for emergencies, but make sure you monitor your payments and pay your credit card bills promptly, which eventually becomes a win-win situation for you.

FAQs

Q. When should you apply for a credit card?

If you can pay back the amount you have spent and have the wisdom to use your credit card prudently without overspending, you must go for a credit card limit increase.

Q. Should I make a full or partial payment toward my credit card dues?

Paying the full amount every month is recommended, as you won’t be charged any interest in this case and are returning whatever you have used.

Q. What is the credit utilisation ratio?

The credit utilisation ratio is the rate of the total credit limit on a credit card you use each month. When you reach the 20% red line, the banks start sending out warnings to pay some amount immediately, which can negatively affect your credit rating.

Q. How is your credit limit decided and offered by banks?

Financial institutions set credit limits based on your solvency. Some major contributors to deciding your credit limit are your income, job profile, consistency of usage and paying bills, credit score, and debt repayment record.

Q. Why should I opt for a credit card limit increase offered by banks?

Increasing your credit limit is always a good idea to provide an unlimited means to meet your lifestyle needs. A lower credit limit means a lack of liquidity which can be stringently used for daily shopping, overseas travel, paying for children’s school fees, and occasional dining out. With a pre-approved credit card limit increase, some banks also offer rewards and points, so it’s best to take them.

Product prices and availability are subject to change. Any price and availability information displayed on merchant's site at the time of purchase will apply to the purchase of these products. HappyCredit is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. As part of this program, we may earn commission from qualifying purchases made through the affiliate links provided on this website. We only promote products on Amazon that we genuinely believe are of high quality and value to our audience. The inclusion of affiliate links does not influence our editorial content or product recommendations. Our primary goal is to provide useful information and help you make informed purchasing decisions.

Certain portions of the text in this article might have been created using AI tools and subsequently edited by the author to improve the overall quality and clarity of the content for readers.

![Increase Your Credit Limit Using These 10 Strategies [August, 2024] Increase Your Credit Limit Using These 10 Strategies [August, 2024]](https://happycredit.in/cloudinary_opt/blog/opt-ecm3ng.webp)