14 Best Finance Books in India [August, 2024]

Finance is a complex yet intriguing subject that affects all aspects of business and personal money management. Having a solid understanding of finance principles and concepts is critical for success, no matter your profession or stage of life. India has a thriving finance industry full of opportunities, but also risks. Educating yourself is the first step to making informed financial decisions.

In this blog, we review the 14 best finance books in India. These books cover a diverse range of topics – from corporate finance to stock market investing to personal money management. We analyze the key features, pros and cons of each book, and provide our expert opinion. Whether you are a student, entrepreneur, investor or personal finance enthusiast, you are sure to find books that meet your needs and help you achieve your financial goals.

/ IN THIS ARTICLE [ hide ]

- How Finance Works

- Accounting and Finance Essentials

- Value Investing and Behavioral Finance

- Corporate Finance (SIE)| 12th Edition

- Finance 101 for Kids

- WISDOM OF FINANCE

- OneStream Finance Rules and Calculations Handbook

- Business Finance & Valuation. Complete Guide to Financial Analysi...

- Finance Book, The

- Strategic Corporate Finance

- Money Management & Financial Budgeting 2 Books In 1

- Financial Statement Analysis Handbook

- The Infographic Guide to Personal Finance

- Stock Market Crashes

- Comparison for Best Finance Books in India

- How to Choose the Best Finance Book

- Types of Finance Books

- Guide on Finance Book Usage, Care and Maintenance

- FAQs about Best Finance Books

- Conclusion

1. How Finance Works

Description

How Finance Works breaks down the world of finance into easy-to-understand terms. The book covers the financial system, money and credit, banks, the power of compound interest, consumer credit, home mortgages, insurance, personal investing, and more.

Key Features

- Beginner friendly introduction to finance

- Uses real world examples to explain concepts

- Focuses on practical personal finance applications

Our Expert Opinion

This book is the perfect starting point for anyone looking to gain financial literacy. The simple explanations make even sophisticated financial instruments easy to grasp. While the book skews more towards personal rather than corporate finance, it provides a solid base of knowledge.

2. Accounting and Finance Essentials

Description

This self-study guide is designed to help entrepreneurs, business owners, and finance professionals better understand key accounting and finance principles central to corporate finance management.

Key Features

- Covers all major accounting and finance concepts including financial statements, cash flows, time value of money, business valuation, working capital management, and more

- Worksheets and templates to apply learnings through sample problems

- Most relevant for small and medium business finance

Our Expert Opinion

This is hand-down one of the best self-study guides for small business owners or entrepreneurs seeking to self-educate in finance and accounting. The abundance of real-world examples make the theoretical concepts very practical. For large corporate finance, supplemental readings may be required.

3. Value Investing and Behavioral Finance

Description

This book provides a deep dive into value investing strategies through the lens of behavioral finance. It explores various stock market anomalies and psychology driven mispricing that create opportunities for value investors.

Key Features

- Actionable framework for creating a long term value investing portfolio

- Explains various biases that cause market inefficiencies

- Global case studies and examples

Our Expert Opinion

This is one of the most insightful books on how human psychology impacts financial markets. By understanding these behavioral phenomena, retail investors can tap into the consistently profitable value investing methodology. The principles are applicable for Indian stock market investors as much as global ones.

4. Corporate Finance (SIE)| 12th Edition

Description

Considered the bible for corporate finance professionals and a staple in top MBA programs globally, Corporate Finance simplifies core financial theories and concepts with practical applications. Now in its 12th edition, it is updated annually to reflect the current state of the field.

Key Features

- The most thorough, up-to-date reference source on corporate finance methodologies and applications

- Advanced valuation models for bonds, stocks, mergers and acquisitions

- Case studies on various financing frameworks – global and Indian

Our Expert Opinion

There is no parallel when it comes to Corporate Finance by Ross et al. Anyone aspiring to be a finance professional must read this book. While some examples are skewed towards Western markets, the theories and models have universal applicability. Requires an intermediate base understanding of finance.

5. Finance 101 for Kids

Description

Finance 101 for Kids delivers essential money lessons – earning, saving, spending wisely, investing, donating – at a child-friendly level. The book uses illustrations and real world examples to develop financial literacy.

Key Features

- Bite-sized explanations of financial concepts

- Activities, puzzles and games for reinforcement

- Local case studies help children relate better

Our Expert Opinion

This book makes finance fun and approachable for children. By simplifying complex themes like compounding, budgeting and financial planning, it instills crucial skills from an early age. The local Indian case studies also help kids grasp the material better. A great parenting tool to set your kids up for financial success.

6. WISDOM OF FINANCE

Description

This highly engaging book elucidates timeless financial wisdom – insights that boost prosperity and wellbeing from the world’s most legendary investors and thinkers like Warren Buffett and Charles Munger.

Key Features

- Curated, evergreen advice that has stood test of time

- Principles applicable to business, investing and personal wealth creation

- Includes lesser known mentors beyond just Buffett

Our Expert Opinion

In an industry constantly chasing the next hot trend, this book brings us back to the fundamentals – wisdom that has proven successful over decades. While not a technical book, it discusses the core philosophies and mental models behind enduring prosperity. A potent distillation that realigns you to essential truths.

7. OneStream Finance Rules and Calculations Handbook

Description

This handbook provides a structured reference guide for configuring OneStream Finance rules, calculations, dimensions and cubes specific to CPG industry needs.

Key Features

- 300+ rules and rule variations for CPG industry requirements

- Guidance on complex calculations like cost and inventory valuation

- Examples and templates for reporting and analysis

Our Expert Opinion

For Finance leaders in consumer packaged goods companies using OneStream Finance software, this handbook is invaluable. It eliminates the need for building calculations and rules from scratch. The sheer depth also allows adapting frameworks for other industries as well with some modification. Very niche, but incredibly useful for target audience.

8. Business Finance & Valuation. Complete Guide to Financial Analysis of Small

Description

This is an exhaustive A-Z guide on business finance and valuation covering financial modeling, analysis, forecasting and more for enabling investment and financing decisions. Applicable across industries, company sizes and stages.

Key Features

- 500+ pages spanning all aspects of finance and modeling

- Real world case studies across industries and company profiles

- Interviews with CFOs and finance professionals

- Excel modeling examples

Our Expert Opinion

This book lives up to its name as a truly complete guide, covering valuation from every dimension. The sheer depth of content coupled with case studies makes it an extraordinarily useful reference guide. Aspiring finance professionals would benefit immensely irrespective of sector or company stage. It simplifies very complex analyses.

9. Finance Book, The

Description

The Finance Book condenses finance fundamentals like investing, banking, risk management, financial engineering and more into succinct lessons using infographics and engaging questions to test retention.

Key Features

- Visually simplified explanations of sophisticated theories and concepts

- Bite-sized lessons for accelerated learning

- Quizzes and puzzles to test knowledge retention

Our Expert Opinion

In an era of declining attention spans, The Finance Book offers rapid finance literacy through its simple and highly visual format. While the treatment of some advanced concepts might over-simplify nuances, it excels as a preliminary knowledge resource and handy reference guide.

10. Strategic Corporate Finance

Description

Strategic Corporate Finance focuses on maximizing firm value through optimal capital budgeting, valuation analysis, risk management, and capital structure strategies. It has a strong applied orientation with real-world examples.

Key Features

- Valuation case studies from emerging markets including India

- Capital budgeting techniques and cost of capital analysis

- Capital structure optimization frameworks

Our Expert Opinion

This book perfectly balances theoretical corporate finance concepts with practical applications. With case studies spanning developed and emerging markets, the insights are broadly transferable. It is ideal for finance leaders involved in corporate strategy, firm valuation and investment decision making. The strategic mindset differentiates it from purely analytical books.

11. Money Management & Financial Budgeting 2 Books In 1

Description

This 2-in-1 book on personal finance covers money management disciplines like budgeting, saving, getting out of debt along with guides on investing, retirement planning and wealth creation.

Key Features

- 30+ chapters spanning credit repair to financial freedom

- Workbook style content with exercises

- Ideal for personal finance basics

Our Expert Opinion

This aptly named book delivers extensive personal finance literacy covering both money management and wealth creation topics, making it one stop shop for novices. While it skews more towards fundamentals, the sheer breadth and simplified style makes it worthwhile as a preliminary resource.

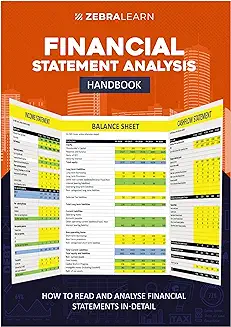

12. Financial Statement Analysis Handbook

Description

This exhaustive handbook on financial statement analysis covers all techniques from fundamentals like ratio analysis to advanced methodologies like residual income valuation and private company valuations.

Key Features

- 300+ pages handbook spanning all aspects

- Real life case studies across industries

- Interviews with equity research professionals

Our Expert Opinion

As far as books focused exclusively on financial statement analysis, very few can match this handbook in terms of depth and practicality of content. The sheer breadth of techniques covered makes this extremely useful for equity analysts, credit analysts and finance professionals involved in analyzing company financials.

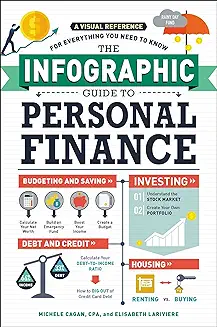

13. The Infographic Guide to Personal Finance

Description

This total beginner guide uses colorful infographics, charts and visual cues to simplify all aspects of personal finance including saving, budgeting, taxes, investing, paying for college and retiring comfortably.

Key Features

- Visually simplified personal finance lessons

- Ideal for financial literacy primers

- Topics from allowances to annuities

Our Expert Opinion

The Infographic Guide excels as a preliminary personal finance resource due to its very visual and non-intimidating style. While it lacks advanced content, for novices especially visual learners, it provides sufficient breadth of financial topics towards developing early literacy.

14. Stock Market Crashes

Description

This book analyzes historical stock market crashes to ascertain root causes around unavoidable crashes versus preventable ones caused by frauds, governance issues or group think. It provides a framework to predict and respond to future crashes.

Key Features

- Chronology and insights into famous stock market crashes

- Framework to forecast and prepare for crashes

- Global case studies including Indian stock market

Our Expert Opinion

This book stands out for its practical framework around distinguishing between normal versus abnormal crashes. The principles around psychology, fraud triggers and governance red flags offer actionable leading indicators that investors can incorporate to safeguard investments against precipitous value erosion during unpredictable crashes.

Comparison for Best Finance Books in India

| Book | Topic Coverage | Key Highlights |

|---|---|---|

| How Finance Works | Personal finance concepts | Beginner friendly, Practical examples |

| Accounting and Finance Essentials | Accounting and corporate finance | Self-study format, Real world case studies |

| Value Investing And Behavioral Finance | Stock market investing | Actionable value investing framework, Behavioral finance concepts explained |

| Corporate Finance | Advanced corporate finance theories | Comprehensive coverage, Updated annually |

| Finance 101 For Kids | Introductory finance for children | Games, puzzles, illustrations, Local examples |

| Wisdom Of Finance | Timeless financial principles | Curated advice from legendary investors, Universal applicability |

| OneStream Finance Rules And Calculations Handbook | OneStream software guide | 300+ rules for CPG industry, Examples and templates |

| Business Finance And Valuation | All-encompassing corporate finance guide | 500+ pages, Case studies across industries |

| The Finance Book | Accelerated finance learning | Visual style using infographics and charts |

| Strategic Corporate Finance | Strategic applications in finance | Balances theory with practical case studies |

| Money Management And Financial Budgeting | Personal finance basics | 30+ chapters covering wide breadth |

| India’s Finance Ministers | Profiles of iconic finance ministers | Eyewitness historical accounts of reforms |

| Financial Statement Analysis Handbook | All financial statement analysis methodologies | 300+ pages with real companies case studies |

| Infographic Guide To Personal Finance | Beginner level personal finance | Highly visual style using infographics |

| Stock Market Crashes | Analysis of market crashes | Framework to predict crashes |

How to Choose the Best Finance Book

With the dizzying array of finance books spanning topics from corporate finance to personal money management, choosing the right book can get confusing. Here is a step-by-step guide:

1. Identify Your Goal

Be clear on what you want to accomplish or learn right now. Your specific situation will determine whether you need introductory knowledge or advanced theories.

2. Match Book Type to Goal

Align book type to your objective – investing manual, company valuation guide, financial modeling handbook etc. Don’t choose books randomly.

3. Research Author Credibility

Finance books teach you to manage money so rely only on qualified experts. Research author qualifications.

4. Customer Reviews

Check online reviews and ratings. It reflects real user experiences and highlights pros/cons. But read critically.

5. Table of Contents

Review table of contents to ensure topics and concepts that are crucial for you are covered to necessary depth.

6. Compare Multiple Options

Weigh 3-5 options around your key parameters before deciding. Avoid becoming fixated on just #1 bestseller.

With so many high quality books on offer on diverse finance topics, the right book that optimally aligns to your specific needs and level is out there! Doing thorough research before you commit ensures you extract maximum value and achieve your financial objectives efficiently.

Types of Finance Books

While we reviewed the 14 best finance books, hundreds more exist that can be broadly categorized into:

1. Introductory Personal Finance Covers budgeting, saving, credit management and other money management disciplines aimed at novices looking for financial literacy without jargon.

2. Advanced Finance Theories Textbooks with in-depth coverage of sophisticated financial theories around valuation, investment banking, derivatives etc. Relevant for students and professionals.

3. Specialized Guides Step-by-step handbooks around specific finance domains like taxation, retirement planning, home buying etc that simplify complex processes.

4. Industry/Company Profiles Books centered around finance history of certain industries or even specific prominent companies and associated financial leaders.

5. General Finance Broad introductory books that provide a helicopter view of the finance world across its domains – banking, investing, risk management etc.

With distinct goals and needs, identifying and zeroing into your relevant category and further shortlisting based on author credibility, topics covered and reviews ensures you find books that perfectly match your priorities.

Guide on Finance Book Usage, Care and Maintenance

1. Handle Books with Care

Avoid dropping them, folding pages or exposing books directly to sunlight or fluids as it deteriorates condition faster. Replace worn out covers.

2. Use Bookmarks

To avoid folding corners which damage pages, use bookmarks while reading. Place books facing up to prevent spine damage.

3. Store Properly

Keep books in cool, dry location away from direct light. An enclosed bookshelf preserves longer. Do not pile too many on top of each other.

4. Do Not Lend Easily

Be very selective whom you lend prized finance books to. Set ground rules on care. It avoids permanent damage or loss.

5. Reinforce Binding

Use archival tape to fix loosening spine bindings before complete tear. Repair loose pages by gluing back in.

6. Consider Insurance

Expensive finance textbooks may warrant personal possessions insurance to safeguard against perils like floods.

Protecting high quality finance books via proper care, handling and storage extends shelf life. Handling books with care also indicates your own appreciation for the invaluable financial knowledge they impart to help achieve your goals.

FAQs about Best Finance Books

Q. what are the best books to start learning about finance ?

The best introductory books to start learning finance fundamentals for personal finance include:

- The Infographic Guide to Personal Finance

- Finance 101 for Kids

- Money Management and Financial Budgeting

For an introduction to corporate finance concepts, Accounting and Finance Essentials self study guide and Finance Book simplify theories using case studies and visually engaging formats without assuming any base knowledge.

Q. Which is the best introductory finance book for novices?

The Infographic Guide to Personal Finance with its highly visual format excels for beginners looking for a broad introduction to personal money management concepts from budgets to portfolios. For corporate finance, Accounting and Finance Essentials self-study guide simplifies fundamentals without overwhelming novices.

Q. What is the most updated, comprehensive corporate finance book?

Corporate Finance (Ross et al.) is undisputed market leader here with its exhaustive coverage of all advanced valuation methodologies and financing frameworks. Now in 12th edition, it gets regularly updated and is used globally in top MBA programs and by finance professionals.

Q. Which finance book is apt for kids?

Finance 101 for Kids does a phenomenal job imparting financial literacy to children using relatable examples, games and puzzles on earning, saving, budgeting and more. The basic money management disciplines prepare them for financial success later.

Q. What is the best book for stock market investing?

For investing, Value Investing and Behavioral Finance provides powerful mental models leveraging human psychology and evolution science towards creating optimal portfolios. It articulates timeless principles that outperform markets sustainably using value picks.

Q. Which finance book has simplest format for accelerated learning?

The Finance Book with its unique infographic style distills sophisticated finance concepts into easy retainable bytes using charts, images and diagrams breaking down complex lessons visually for rapid retention even for novices.

Q. Who is the author with most books in list of 14?

No single author has authored more than one book amongst the diverse 14 specializing in niches from corporate finance to banking history. Ross et al. does have two books including an older core textbook and specialized version highlighting strategic applications.

Conclusion

We hope this comparative analysis provides clarity into the 14 best finance books applicable for India across various specializations – from corporate finance to personal money management to stock market investing. The books reviewed cover the full spectrum from introductory primers to advanced theories to highly specialized applications enabling you to make the optimal choice aligned specifically to your situation and needs. Remember, books that impart financial wisdom pay you dividends many times over throughout your lifetime. So invest carefully after thorough research! Keep learning.

Product prices and availability are subject to change. Any price and availability information displayed on merchant's site at the time of purchase will apply to the purchase of these products. HappyCredit is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. As part of this program, we may earn commission from qualifying purchases made through the affiliate links provided on this website. We only promote products on Amazon that we genuinely believe are of high quality and value to our audience. The inclusion of affiliate links does not influence our editorial content or product recommendations. Our primary goal is to provide useful information and help you make informed purchasing decisions.

Certain portions of the text in this article might have been created using AI tools and subsequently edited by the author to improve the overall quality and clarity of the content for readers.

![14 Best Finance Books in India [August, 2024] 14 Best Finance Books in India [August, 2024]](https://happycredit.in/cloudinary_opt/blog/best-finance-books-1ua7a.webp)